The Great Onchain Migration

A New Fintech Playbook: Tokenization as a Gravity Well

In 2025, tokenization crossed from concept into inevitability.

It’s been nearly a decade since I helped draft J.P. Morgan’s first designs for asset tokenization. At the time, the idea that securities could settle on public infrastructure felt radical. But one thing was clear:

Once the rails became programmable, the structure of capital markets would eventually follow.

Today, that hypothesis is playing out at hyperspeed.

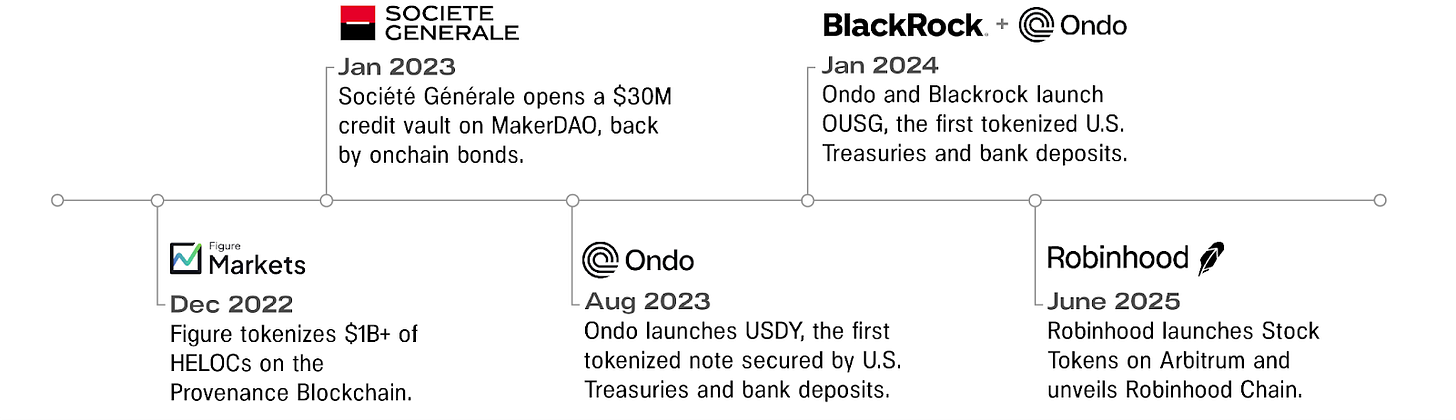

More than $24 billion in real-world assets now exist on public blockchains, up over 3× since the start of 2023. Nearly 200 issuers—from BlackRock and Franklin Templeton to Siemens and J.P. Morgan—have placed real capital onchain.

Fintechs aren’t satisfied being front-ends for legacy infrastructure anymore; they’re building the new rails themselves.

And for the first time, corporates are issuing on public blockchain infrastructure.

Several weeks ago, Robinhood broke new ground by announcing the launch of Stock Tokens—tokenized stocks, ETFs, and private company shares—on Arbitrum, the leading Ethereum Layer 2. CEO Vlad Tenev also revealed plans for Robinhood Chain, an Arbitrum-powered network designed for 24/7 global trading of tokenized assets.

A Gravity Well is Forming

The infrastructure of capital markets is moving onchain. And with it, the strategic playbooks of fintechs, corporates, and investors are being rewritten in real time.

We’re witnessing a mass migration to the next-generation infrastructure for moving, clearing, and valuing capital assets.

A gravity well is forming around the early liquidity flows—and it’s already pulling the center of gravity for price discovery, capital formation, and global liquidity away from Wall Street’s ancient pipes and onto modern blockchain rails.

gravity well (definition): A model of the gravitational field around a massive object. It represents how the object's mass curves or warps spacetime, creating a "well" that attracts other objects. The deeper the well, the stronger the gravitational force, and the more energy is needed to escape its pull.

The question now is: what happens next?

Financial Physics in Motion

If Isaac Newton worked on Wall Street, his First Law might read:

"Assets move in the direction of least resistance - unless acted upon by regulation."

Put differently: Assets will eventually flow to where they can:

Move most freely (global, 24/7, software speed)

Trade most cheaply (automated, minimal middlemen)

Be valued most completely (global discovery, composability, collateral utility)

Blockchains are finally making that possible.

I’ve watched this migration unfold from inside a global bank at J.P. Morgan and across the venture ecosystem at Pantera. What looked impossible in 2015 is now operational—and accelerating.

Like eurodollars in the ‘60s, ADRs in the ‘90s, or ETFs in the ‘00s, the liquidity for tokenized assets will pool first on the margins and then cascade toward the center.

Tokenized treasuries, private credit, and now equities are the early signals:

Today, Figure has processed over $41B in transactions. Ondo has issued over $1B in tokenized Treasuries and is now expanding into equities through Ondo Global Markets.

Tokenization is expanding the footprint of capital markets to be truly global for the first time.

The most desirable issuers will follow liquidity and access global capital pools in one click, made possible only through onchain settlement.

The most forward-thinking investors will demand portability, transparency, and the utility that only onchain primitives can offer.

The New Fintech Playbook

The winning playbook for disruptive FinTechs used to be: “Become the bank before the bank becomes you.”

Tokenization has unlocked a new way to win: Don’t become a bank. Become the infrastructure.

Robinhood’s recently announced launch of Robinhood Chain is a blueprint. Rather than compete on front-end UX or margin rates, Robinhood is turning its user base into liquidity for its own blockspace.

Here’s how Vlad and his team described the Robinhood Chain:

This is the first blockchain with the technology and regulatory infrastructure needed to carry the entire traditional financial system on its back into the future…. Our goal with stock tokens on the Robinhood Chain is that in the near future, you will be able to seamlessly transfer your assets in seconds and your ability to trade will not be reliant on any individual broker or counterparty.

Wait, but doesn’t this threaten Robinhood’s core brokerage business?

Not if it gives them the opportunity to transform the entire capital markets stack and re-position themselves as a dominant, vertically-integrated platform.

The logic is simple: If you own the distribution (users), and the interface (app), why wouldn’t you also serve as the rails (infrastructure)?

Historically, Robinhood and other platforms have suffered from:

a permanent storage tax paid to custodians and central depositories,

slow, expensive settlement cycles, enforced by clearinghouses and banks,

limited access to new assets, due to bottlenecks from exchanges and legacy rails.

By migrating onchain, Robinhood is escaping the hidden taxes of financial sharecropping and the overhang of legacy infrastructure.

Robinhood isn’t alone in launching their own chain. Coinbase’s layer-2 chain Base is among the fastest-growing blockchain ecosystems. It’s also driven over $100 million of revenue to date for Coinbase. But more importantly, these new corporate chains represent a step towards internalizing the benefits of programmable finance: fees, flows, and future optionality.

In every case, the model is the same: own the sequencer, own the economics. As vertically-integrated market venues, they can capture (or reduce) trading spreads, custody fees, and infrastructure rents that previously belonged to legacy institutions.

But owning the sequencer isn’t simply about capturing fees. It’s about owning liquidity, owning distribution, and eventually owning capital formation.

Fintechs that control all three won’t need to ask permission from transfer agents, clearing firms, or exchanges. They’ll launch global capital markets from a wallet app - with composable apps, enforceable rights, and real economic gravity.

With a vertically integrated chain, a fintech business can:

List tokenized assets as permissionlessly and as easily as an API;

Monetize transaction volumes more fairly and cheaply, disrupting traditional Wall Street fees with usage-based pricing, as SaaS models have done to many industries;

Let third-party developers build apps on top of their liquidity flows and asset inventory, such as asset lending, structured products, insurance, and portfolio management tools;

Demonstrate transparency and programmable controls for regulatory compliance.

Robinhood doesn’t need to build a securities lending desk for tokenized equities. Morpho can deploy on Robinhood Chain, while Robinhood simply routes users to Morpho’s smart contracts. This is an evolution from app developer to platform operator.

We’re entering a new phase of the tokenization cycle, where the most powerful distribution platforms on Wall Street can launch new infrastructure for themselves and become the most desirable venue for trading, payments, and capital formation.

The Re-Platforming of Capital Markets

It’s not just fintechs. Some of the most systemically important institutions in the world are now issuing and settling assets onchain.

When I departed J.P. Morgan’s blockchain team in 2018, it was partly out of impatience. I assumed corporate adoption of public blockchains would take 2 more years. That turned out to be ambitious. Seven years later, the inflection point is here.

BlackRock’s BUIDL fund crossed $375 million AUM within six weeks of launch. It now exceeds $2.6 billion and pays USDC-denominated dividends natively on Ethereum. J.P. Morgan’s blockchain platform processes intraday repo trades on a private Ethereum fork, settling collateral in minutes instead of days. In 2023, Siemens issued a €60 million digital bond directly on public Ethereum - no bankers required. Similarly, Société Générale issued a digital green bond on Ethereum in 2023, with participation from regulated institutions like AXA and Generali. Those successful pilots were the early indicators of a coming wave.

Institutions are now waking up to the fact that we no longer need:

Investment banks to facilitate capital access

Correspondent banks to patch together global distribution

T+2 settlement cycles that delay liquidity and inflate risk

Public blockchains offer global reach, instant settlement, and programmable logic. For corporates facing rising capital costs and fragmented investor bases, the ability to issue debt (and eventually equity) at the click of a button and instantly tap into global liquidity is too attractive to ignore.

Fintechs are building chains to own distribution and monetization. Corporates are issuing onchain to lower cost of capital and expand access.

Both are converging on the same conclusion:

Public blockchains are the most credible infrastructure for operating the world’s first truly global capital markets, always on and universally accessible.

The Right to Travel, but Not to Own (Yet)

Yet most of what’s called “tokenization” today is still incomplete. We’ve built the highways. But the gates into the city center - the courts, the cap tables, the governance - are still locked.

Today, you can trade tokenized stocks and Treasuries onchain. But don’t mistake that for full ownership. Your rights - to vote, inspect, or enforce - remain trapped in offchain constructs: SPVs, custodians, transfer agents. We’ve given investors the right to travel, but not the right to own (yet).

As liquidity grows and investors experience the benefits of their tokenized portfolios, there will be mounting pressure on issuers to extend full shareholder rights to tokenholders. Some investors won’t wait. They’ll tokenize their portfolios themselves, then ask for forgiveness later.

This tension of issuer rights vs. investor rights will likely be one of the definitive battlegrounds during the next decade in tokenization.

Who controls shareholder privileges when the asset lives onchain, but the registry doesn’t? What happens when tokenholders want more than transferability and price discovery - when they want the power that comes with true ownership?

As SEC Commissioner Hester Peirce recently put it, the promise of tokenized securities is “enchanting, but not magical.”

That promise won’t be fulfilled by wrapping assets in digital form. It will require issuers to shift their mindset towards native onchain issuance, from an experimental sandbox to the default path for accessing global capital pools.

The Tipping Point for Tokenization

The rise of tokenized assets today mirrors the early days of ETFs.

When the first U.S. equity ETF (SPY) launched in 1993, it crossed $1 billion in AUM within a year. But the real inflection point wasn’t its size. It was when ETF volumes began consistently matching and eventually exceeding mutual fund flows. That’s when market structure changed and investor behavior soon followed.

Tokenization will hit a similar moment in broad market structure transformation and issuer & investor behavior.

I believe that the tipping point arrives when any of the following occur:

Daily onchain equity volume exceeds $1B, comparable to lower-tier ADRs or long-tail ETFs;

Tokenized equity AUM crosses $100B, giving confidence to systemic allocators (sovereign wealth funds, pensions, endowments) to embrace tokenization’s benefits in their portfolios;

A top public company (S&P 500 or Nasdaq 100) see more liquidity onchain than their home exchange or ADR equivalent;

A global IPO listing bypasses New York entirely and issues onchain directly or in a financial hub with stronger regulatory and policy frameworks for onchain issuance.

Today, we’re still early. Tokenized equities currently trade ~$300M in average monthly volumes. But what matters is the acceleration rate. Those volumes represent a 350% increase in volumes over the past month, with many prominent launches like Robinhood’s Stock Tokens and Ondo Global Markets still in the early stages.

If adoption continues at this healthy pace, the $1B daily volume threshold could be achievable within 2-4 years, depending on a few potential catalysts:

Regulatory clarity around tokenized asset wrappers and natively-issued onchain equity;

Financial app-specific chains reaching scale in performance and liquidity, e.g., Robinhood Chain, Ondo Chain, Provenance Blockchain (and certainly more to come);

Abstraction of UX barriers that bring onchain assets to retail investors without wallets or gas requirements;

Portable compliance layers that abstract KYC/AML checks and travel natively alongside tokens, unlocking cross-border liquidity safely and compliantly.

When it happens, it will feel obvious in hindsight as tokenization’s “ETF moment.”

Today’s early adopters are focused on applying a better set of rails, but the biggest story is the structural shift in the future of capital markets. Once the migration is complete, blockchains will be recognized as the default destination for capital formation, price discovery, and value transfer. The first and last stop for issuers and investors.

Having helped develop some of the earliest blueprints for tokenization, I can say with conviction today: the rails are here, the liquidity is flowing in, and the momentum is real.

The gravity well has formed. Now we watch what gets pulled in.