The Most Neglected Asset in the World

A Trillion Dollar Opportunity Hiding in Plain Sight

[originally written in Nov 2023 (BTC price at ~$35k)]

What if I told you that an asset with:

$1 trillion market cap (60% larger than Visa)

$26 billion of daily trading volume (250% more than Apple)

50% annualized volatility (20% less than Tesla)

220+ million holders globally (# of countries with populations of 220+ million: Six)

… was ignored and exiled from the world’s “leading” financial institutions for 10 years? Would an ETF satisfy you?

No. Not when Bitcoin continues to be one of the world’s most under-served and under-financialized assets, relative to its size and scale.

Bitcoin is the most neglected asset in the world.

Bitcoin is one of the most unique assets in the crypto ecosystem. Its market cap and volumes are ~2.5x greater than Ethereum. The Bitcoin network serves as a digital Fort Knox. It's a fortress backed by ~500 times the computational power of the world’s fastest supercomputer. There are over 200 million Bitcoin holders vs. 14 million Ethereum holders globally. And Bitcoin still stands alone in a sea of regulatory gray - recognized, classified, and treated as a digital commodity.

If Wall Street’s financial system won’t build for Bitcoin, then Bitcoin will have to build a financial system for itself.

If blockchain technology can help bank the unbanked, the most obvious route is through Bitcoin’s global distribution in Latin America, Africa, and Asia. This already encompasses millions of people. If we expect trillions in value to eventually flow on-chain, there’s no network more secure or resilient than the Bitcoin network. As Bitcoin reaches a billion people and more, they’ll want to do more than store and move their assets. Capital and technology rarely stand still. This time is not different.

Bitcoin is Technology

As much as Bitcoin has been neglected as an asset, it may be even more neglected as a technology. Bitcoin has lagged behind in scalability, programmability, and developer interest. My first attempt at building on Bitcoin was in 2015, during the earliest days of J.P. Morgan’s crypto R&D. There was little to explore beyond colored coins and sidechains. Those were early ancestors to today’s NFT renaissance and Layer-2 rollups.

The verdict at the time was: it’s too damn hard to build on Bitcoin. Ask David Marcus, former President of PayPal and Co-creator of Meta’s Diem stablecoin. He's now building Lightspark, a Bitcoin payments company. David tweeted recently:

“Building on Bitcoin is at least 5x harder than building with other protocols.”

As money and technology, Bitcoin’s blessings are its curses:

Resistance to change: This anchors Bitcoin’s robustness, but also its sluggishness. Upgrades are difficult to approve and can take 3-5 years to install.

Simplicity in design: This makes Bitcoin less exploitable, but also less flexible. The Bitcoin blockchain’s UTXO model is well-fit to serve a simple transactional ledger for payments. Yet, it's mostly incompatible with complex logic or loops you need for more advanced financial applications.

10-minute block time: This helps keep the Bitcoin network synchronized with 100% uptime since 2013 (a rare achievement), but disqualifies it from a large swath of consumer experiences.

Today I’m seeing signs that Bitcoin’s developmental malaise is a temporary, non-structural condition. A decentralized financial system may finally be emerging with Bitcoin at its foundation. Its potential is similar or greater than DeFi on Ethereum today, albeit following a different evolutionary path.

Why Now?

Over the past several years, Bitcoin has unlocked a new developmental trajectory:

Taproot upgrade (Nov 2021): An upgrade that expanded the amount of data and logic that Bitcoin transactions can store.

Ordinal inscriptions (Jan 2023): A Taproot-enabled protocol for inscribing rich data to individual satoshi’s (2.1 quadrillion in total). This enables a metadata layer for non-fungible tokens.

BRC-20 tokens (Mar 2023): A type of Ordinals inscription that enables deploy, mint, and transfer functionality.

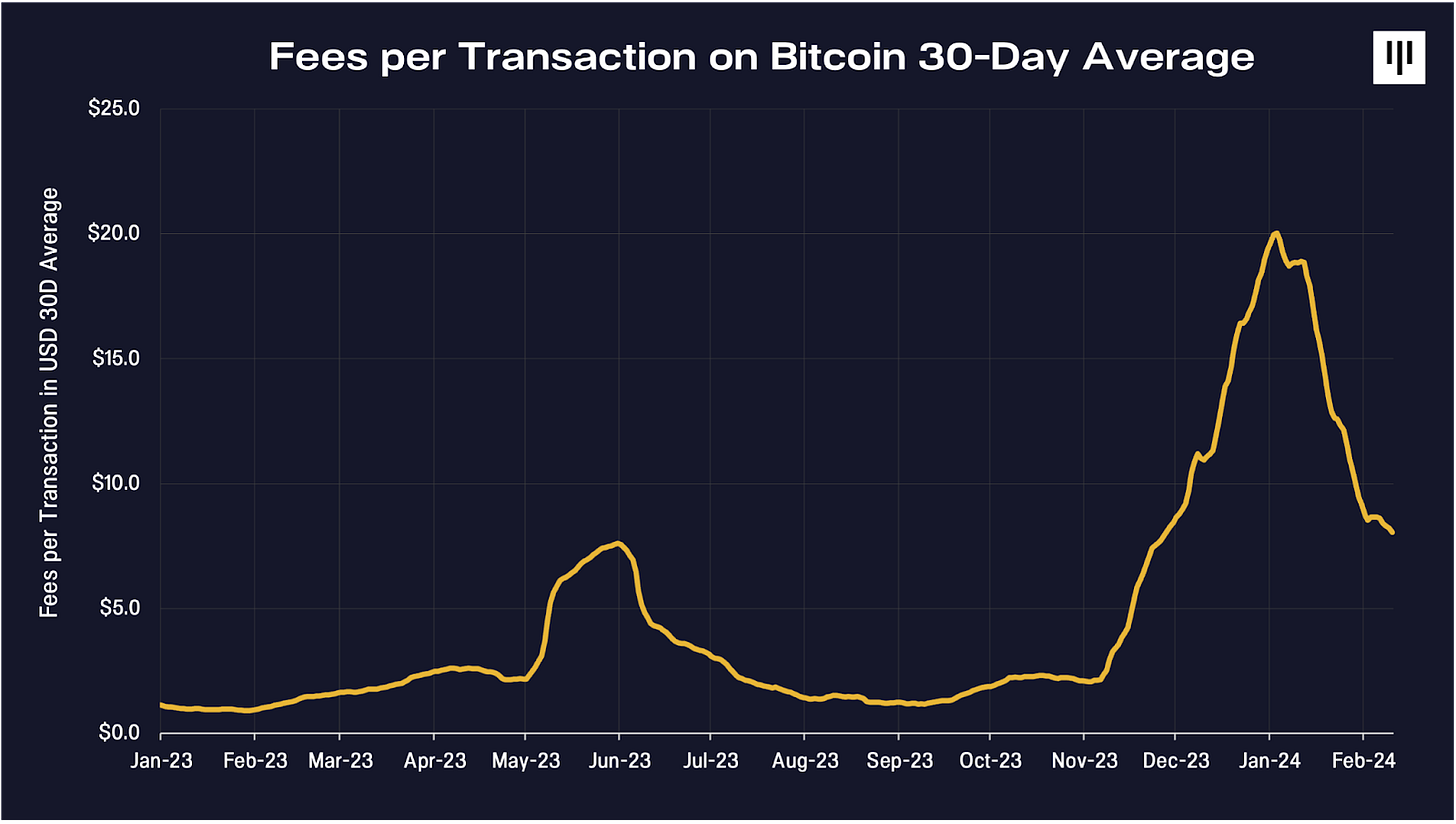

The unleashing of fungible and non-fungible assets kicked off the first waves of DeFi and NFT activity on Ethereum in 2016-2017. Early signs of that same growth are now bubbling to the surface. Bitcoin average fees per transaction rose 20x in 2023, driven by Ordinal inscriptions.

Bitcoin is bound to take its own path, but it’s clear that a new design space has opened up for Bitcoin builders.

Larger macro trends have ignited a psychological shift within the Bitcoin community and renewed appetite from Bitcoin investors for decentralized finance on Bitcoin:

Layer-2 adoption: Layer-2’s like Arbitrum have dominated new DeFi activity over 2023. This shows it’s possible to scale blockchain capacity and programmability without changing the base layer.

Acceptance by traditional institutions: Bitcoin broke through a major regulatory hurdle with its ETF approval, pulling capital flows and entrepreneurial mindshare back into its ecosystem. BlackRock and Fidelity are activating the slow-but-powerful engines of Wall Street. Trading houses are licking their chops and looking for every marginal source of Bitcoin liquidity. This could soon draw them into DeFi, especially with new institutional DeFi gateways like Fordefi.

Failures by crypto-native institutions: When counterparties like FTX, BlockFi, Celsius, and Genesis fell, it was crypto’s homegrown Global Financial Crisis. An entire generation of investors has soured on trusting their Bitcoin to centralized financial services.

In hindsight, it will be obvious: Technological unlocks and macro trends are converging towards a breakthrough moment for DeFi on Bitcoin. Now is the time to seize that moment.

The Half Trillion Dollar Opportunity

The prize for enabling DeFi on Bitcoin is tantalizing. Beyond the social and economic importance, every early builder and investor should ask: What if it works? How much is DeFi on Bitcoin worth?

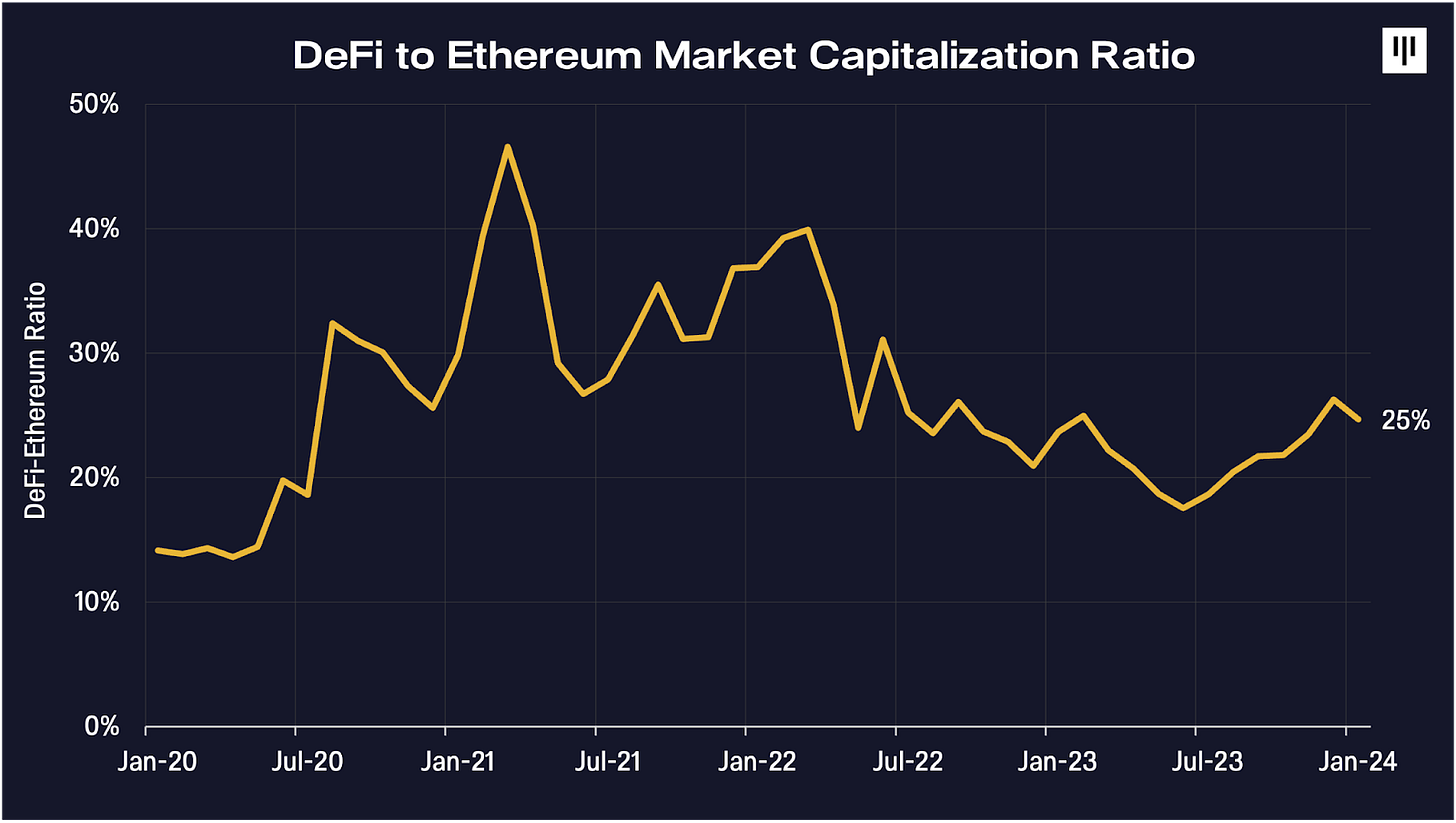

Ethereum, valued at ~$300 billion, hosts much of today's DeFi activity. DeFi applications built on Ethereum have historically ranged between 8% and 50% of Ethereum’s market cap. They currently stand at about 25%. Uniswap is the largest DeFi application on Ethereum, valued at $6.7 billion or ~9% of all DeFi apps on Ethereum.

If DeFi reaches Ethereum's proportions on Bitcoin, we could expect the total value of DeFi applications on Bitcoin to be worth $250 billion (25% of Bitcoin). Over time, it could range between $72 billion and $500 billion (8% and 50%). This assumes no change in Bitcoin’s current market cap.

The leading DeFi application on Bitcoin could eventually be valued at $20 billion (2.2% of Bitcoin), ranging between $6.5 billion and $40 billion. This would place it squarely in the top 10 most valuable assets in the crypto ecosystem. Bitcoin is nearly back to being a trillion-dollar asset. Yet, it still holds an untapped half-trillion dollar opportunity.

Looking Ahead

Over the past three years, a wave of progress towards Bitcoin programmability has been building on the horizon. Examples include: Stacks, Lightning, Optimistic rollups, ZK-rollups, Sovereign rollups, Discreet Log Contracts. More recent proposals include Drivechains, Spiderchain, and BitVM.

But the winning solution won’t break through on its technical merits alone. The winning approach to enabling DeFi on Bitcoin will need the following:

Economic alignment with Bitcoin: Any programmable Bitcoin layer should tie directly to Bitcoin’s economic value and security. Otherwise, users may see it as hostile or parasitic to Bitcoin. Alignment can take the form of bridged BTC as L2 collateral and gas payments. It can also involve using the Bitcoin network for settlement and data availability.

Viability without base layer changes: Some proposed solutions need a hard or soft fork of Bitcoin. This means a system-wide upgrade. Considering how rare these are, it’s unlikely that these will be early contenders. However, some are worth pursuing long-term.

Modular architecture: The winning solution needs to be upgradeable enough to incorporate new technical advances. We already see the state of the art shifting in on-chain custody, consensus design, VM execution, and zero-knowledge applications. Semi-closed systems with proprietary stacks won’t be able to keep up.

Trustless bridging: Bridging assets from one chain to another is incredibly hard. If done right, it's as challenging as interplanetary transport, given the potential mishaps involved, from latency mismatch to debilitating exploits. Few decentralized bridges have been attempted and validated in the wild. One example is tBTC, which continues to evolve its design and decentralization.

A relentless ground game: Two audiences matter for growth. 1) Current Bitcoin holders, and 2) Future Bitcoin builders. Both are dispersed in esoteric ways. Exchanges hold approximately 10-20% of the total supply of Bitcoin. Around $10 billion of Bitcoin sits in various tokenized forms on Ethereum. Developer mindshare is spread across a multi-chain, multi-layer stack. Onboarding both groups will need a “meet them where they are” mindset.

Bitcoin’s age of neglect may finally be coming to an end. In the post-ETF era, Wall Street is finally realizing the obvious about Bitcoin as an asset. The next era will be about Bitcoin as technology and the re-ignited excitement to build for Bitcoin.

[Note: This post was co-published in the February 2024 issue of the Pantera Blockchain Letter.]